Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018. Examples of zero-rated supply as prescribed based on tariff code in GST Zero-rated Supply Order 2014.

GST is part of the overall tax reform to make the taxation system more effective efficient transparent business friendly and capable of generating a more stable source of revenue.

. Service Tax 6. Mapping of GST tax codes Contd Additional GST tax code for special scenario industry Special GST scenario such as bad debts relief. GST State Code List of India.

1 Government Tax Code. Real Property Gain Tax Payment RPGT 5. Goods and Service GST Act 2014.

Manufactured in Malaysia by a registered manufacturer whenever sold used or disposed by him and on taxable goods imported into Malaysia. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018.

The current browser does not support Web pages that contain the IFRAME element. MY country code letters followed by 15 digits. Supply of goods and services made in Malaysia that accounted for standard rated GST.

As of 3rd December 2014 the whole tax code list in MYOB Malaysia is reproduced below. Jabatan Kastam Diraja Malaysia Appendix 2 - Guide to enhance your accounting software to be GST Compliant Draft as at 13 March 2014 TX. For purchases with input tax where the GST registered entity elects not to claim for it.

The tax codes list window displays all the GST codes available in MYOB. Under the Sales Tax Act 2018 sales tax is charged and levied on imported and. Input Tax Not Claim ND.

To view the GST Tax Codes in MYOB open your company file then click on Lists Tax Codes as shown in the image below. Goods and Services Tax. VAT in Malaysia known as Sales and Service Tax SST was introduced on September 1 2018 in order to replace GST Goods and Services Tax.

Purchase list by tax code. Input Tax 6 - GST incurred and choose not to claim the input tax. Yes if the purchase was made 3 months before the tourist departs from Malaysia.

Here is a list of tax codes that are. However sales tax is not charged on goods and manufacturing activities. There are 23 tax codes in GST Malaysia and categories as below.

Goods Services Tax 0. If Custom changes anything MYOB will update the list for you if you are subscribed for their year support. While migrating to a GST registration or while going for a new registration most businesses would have received the 15 digit provisional ID or GSTIN Goods and Services Tax Identification Number.

Petroleum Downstream revised as at 17 February 2016 Petroleum Upstream revised as at 22 December 2015 Postal and Courier Services revised as at 5 January 2016 Pre-tertiary Education revised as at 11 november 2015 Professional Services revised as at 13 January 2016 Repossession revised as at 5 November 2015. GST was only introduced in April 2015. SST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system.

You need to fill in the fields as shown especially the tariff code default tax rate if your products are taxable. GST on purchases directly attributable to taxable supplies. Income Tax Payment excluding instalment scheme 7.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. Mapping of GST tax codes RMCDs recommended 23 tax codes Key steps involved in GST mapping process 0330 pm. GST is suspended on the importation of goods made by a ATS holder.

Sales Tax 5. Monthly Tax Deduction MTD 6. And you must also pay bank fees to banks.

Explanation of Government Tax Codes For Purchases. Purchases with GST incurred at 6 and directly attributable to taxable supplies. The fixed rate is 6 and some types of goods and services can be exempt from this tax while others are taxed at different rates.

Examples includes sale of air-tickets and international freight. GST List of Zero-Rated Supply Exempted Supply and Relief in Malaysia The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. GST code Rate Description.

Additionally a configurable GST report by configuration report is provided to meet the following reporting requirements. GST tax codes rates. A GST registered supplier can zero-rate ie.

It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Otherwise subscribe to update from Royal Malaysian Custom for GST and if there are changes you can edit the list yourself.

Input tax on purchases made from GST registered suppliers by local authorities or statutory bodies to perform regulatory and enforcement functions. The access to the tax code list menu is the same for both MYOB Accounting and MYOB Premier. What is the treatment when the GST rate is standard rate of 0.

SST is administered by the Royal Malaysian Customs Department RMCD. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6For more information regarding the change and guide please refer to. Recommended Tax Codes for Goods Services Tax.

The existing standard rate for GST effective from 1 April 2015 is 6. If your products are non. Different Types of SST in Malaysia under Deskera Books.

Charging GST at 0 the supply of goods and services if they export the goods out of Malaysia or the services fall within the description of international services. Per Malaysia GST regulations GST will be applied to the bank charge. Knowing the structure of the GSTIN is crucial for a business - to ensure that ones suppliers have quoted the.

Normal rules apply to the declaration of the GST-03 return and tax code. Sales Tax 10. GST Tax Codes for Purchases.

The introduction of GST in Malaysia is to replace the current consumption tax Sales Tax and Service Tax which has many weaknesses. Malaysia GST Reduced to Zero. COFFEE BREAK 0400 pm.

The bank will provide a GST invoice to you and you can claim the GST.

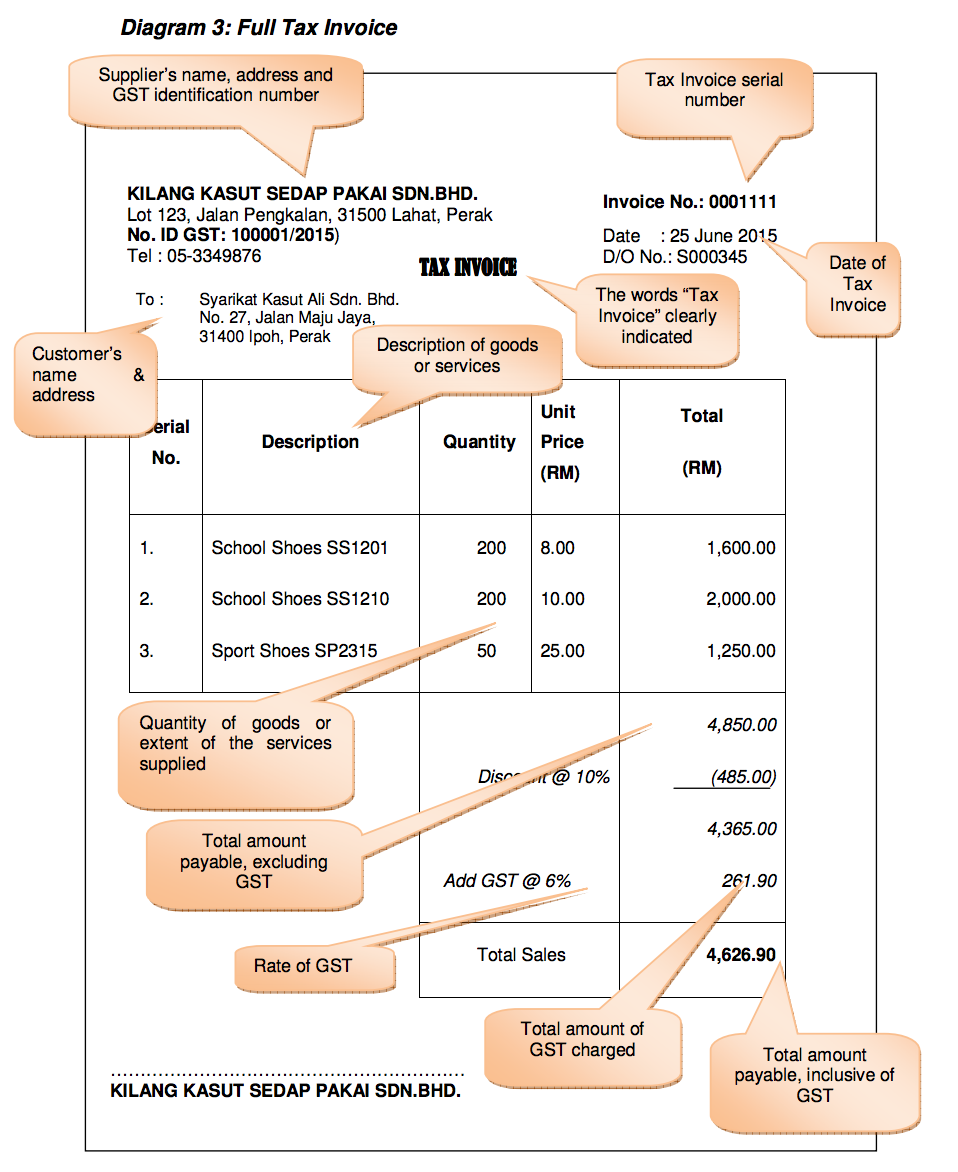

Basics Of Gst Tips To Prepare Gst Tax Invoice

How A Perfect Gst Tax Invoice Should Look Like Eztax In Gst Help Invoicing Financial Accounting Tax

Implementation Of Goods And Service Tax Gst In Malaysia Yyc Goods And Services Goods And Service Tax Malaysia

Yyc Advisors Recommended Gst Tax Code Listings For Supply Source Accounting Software Enhancement Towards Gst Compliance Revised As At 18 July 2016 By Customs Facebook

Product Excluded From Gst Petroleum Product Alcohol Tobacco Product Purchase Tax Zero Rating For Tobacco Products Goods And Service Tax Alcohol

Non Deductible Tax Code Bl Sap Blogs

Complete Sst System Setup Guideline Help

The Biggest Tax Transformation Gst Is About To Govern The Calculations Soon Don T Go Hay Way With The Comprehension Of Comprehension Problem Solving Education

How To Remove The Gst Summary From An Invoice Solarsys

Complete Sst System Setup Guideline Help

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

Import Goods That Have Gst Finance Dynamics 365 Microsoft Docs

The Brief History Of Gst Goods And Service Tax Goods And Services Goods And Service Tax Get Gift Cards

Finally Gst Goods And Services Tax Bill Has Been Passed In Rajya Sabha India We Would Be Hel Creative Advertising Goods And Service Tax Creative Branding

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

Deemed Supplies Scenarios Malaysia Gst Sap Blogs